Asset Owners

Asset Owners

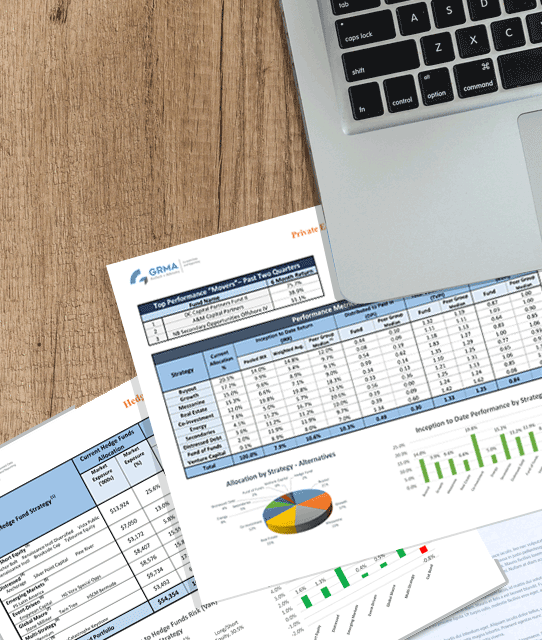

Today, asset owners and institutional investors, in particular, have pressing needs for critical data and reporting for portfolio monitoring, investment screening and asset allocation. Most institutions are challenged because they go through a time consuming and manual process for producing their monthly or quarterly reports for their investment committee and/or board. Typically, the data and reporting that is readily available internally from their institution or externally such as from their custodian bank is not adequate for reporting purposes and sound investment management.

Typical Asset Owner’s Challenges

Significant Time and Resources Spent on Board/Investment Committee Reporting

• Aggregating investment data that is scattered in multiple sources

• Manual and spreadsheet-driven processes to do complex reporting

No Aggregate View of the Entire Investment Portfolio including:

• Liquid investments (e.g. equities, fixed income, etc.)

• Illiquid investments (e.g. hedge fund, private equity, real estate, etc.)

Lack Robust Analytics for Meaningful Reporting

• No risk management metrics

• No deep dive performance attribution

• No actionable decision-analysis

• Difficult to do portfolio management and risk monitoring

No Centralized Investment Database

No Dashboard for Portfolio Monitoring

Complete Solution

GRMA has developed an innovative SaaS solutions for data aggregation and reporting that is both complete and cost effective for all types of asset owners.

In order to address the scattered data challenges that most asset owners face, we have developed unique technology including artificial intelligence and machine learning to efficiently scrape, extract, aggregate, and curate all investment-related data.

In addition, GRMA can provide ancillary advisory services necessary so that asset owners are fully in line with best practice standards and leading peers.

Types of Reporting and Advisory Services

Comprehensive Board and Investment Committee Reporting

Aggregate Portfolio Exposure:

• Liquid Investments

• Illiquid Investments

Complete Asset Class Coverage:

• Equities

• Fixed Income

• Commodities

• Hedge Fund

• Private Equity

• Real Estate

• Venture Capital

• Real Assets

Performance:

• Benchmarking

• Attribution

• Performance vs. Peers

Reporting Options:

• Monthly and Quarterly Reporting

• Custom Reports – Board and Investment Committee

• Custom Dashboards/Applications for portfolio monitoring

Compliance Reporting

Pre-Investment Analysis

• Investment Screening and Due Diligence

• Asset Allocation Impact Scenarios

Public Market Equivalent (PME) Reporting

• PME analysis for alternative investments—performance comparison vs. public market benchmarks

• PME metrics including: Standard Metric, Cash Flow-Weighted Metric and Direct Alpha

Risk Management

• Value-at-Risk (VaR)

• Drawdown/Funding Gap Analysis

• Scenario Analysis/Stress Testing

• Hedging Review and Advisory

• Asset and Liability Management Studies

ESG Reporting

Scoring and Compliance Reporting for Environmental, Social and Governance Investing

• Global Data Coverage: over 330,000 funds, 9,000 listed companies, representing 80%+ of global market cap

• Comprehensive Indicators and Metrics: over 70 key ESG indicators and 400 ESG data metrics

• Relative benchmarks: offer all comparable industry and country benchmarks and peer analysis

• Breadth and Depth: provide both position level and overall fund level ESG metrics, scores, ratings and analysis

• Curated Data, Reporting or Dashboard: for monitoring, compliance with IPS and Board/Investment Committee Reporting

Expert Advisory Services

• Investment and risk management governance and process and controls

• Investment risk management policies and procedures

• Risk management limits and policy guidelines

• Hedging and risk mitigation advisory

GRMA’s Unique SaaS Solution Features:

No need for software and additional staff

No lengthy or client-side implementation

Significant time and cost savings for all reporting

Superior to in-house build or all other “buy” options

Greatly improve work flows for data management, reporting and portfolio monitoring

Most complete and cost-effective solution for investment data aggregation and in-depth reporting and analysis

• Curated data file

• Customized reports

• Dashboard

• Secure cloud storage

Find out what our solutions can do for your institution or company.

SITEMAP

CONTACT

MAIN OFFICE: 212-230-1099

GENERAL: INFO@GRMAINC.COM

HIRING: HIRING@GRMAINC.COM

ADDRESS: 757 THIRD AVENUE, 20th FLOOR NEW YORK, NEW YORK 10017